You are about to launch on an important journey to find your ideal home, whether you’re buying or renting. This guide is specifically tailored for physicians like yourself, who often face unique challenges in the real estate market. You’ll gain valuable insights into market trends, financial considerations, and practical steps to make informed decisions. Equip yourself with the knowledge to navigate the complexities of real estate, ensuring that your next move aligns with both your professional and personal life.

Types of Real Estate Options

The real estate market offers a variety of options to suit your lifestyle and budget. Here’s a breakdown of the main types:

- Single-family homes

- Condos

- Townhouses

- Co-ops

- Multi-family homes

After evaluating these options, you can make an informed choice that aligns with your needs and preferences.

Buying vs. Renting

One key decision you need to make is whether to buy or rent your new home. Buying typically offers stability and potential investment growth, whereas renting provides flexibility and less responsibility for maintenance. Consider your long-term plans and financial situation when weighing these choices.

Single-family Homes vs. Condos vs. Townhouses

Townhouses are a popular choice for those seeking a blend of community living and privacy. Generally, they offer more space than condos while still providing lower maintenance than single-family homes. This makes them appealing for busy professionals and families alike.

Options available in the real estate market largely depend on your lifestyle and investment strategies. Single-family homes give you more privacy and control over your property, while condos typically require less maintenance, as amenities and landscaping are often managed by an association. Townhouses offer a middle ground with shared walls but the potential for a yard or garden. Understanding these differences will help you choose the best option for your needs.

Factors Influencing the Market

If you are considering entering the real estate market, several factors can significantly influence your buying or renting decisions. These include:

- Interest rates

- Supply and demand

- Government policies

- Economic trends

- Demographics

Recognizing these influences will help you make more informed choices in your next housing endeavor.

Economic Indicators

Now, understanding economic indicators is crucial when navigating the real estate market. Key statistics such as unemployment rates, inflation, and consumer confidence can affect housing prices and availability. Monitoring these indicators helps you gauge market stability, enabling you to time your purchase or rental more effectively.

Location and Neighborhood

Indicators of a location’s desirability can significantly impact your real estate decisions. Factors such as school quality, crime rates, and proximity to amenities like hospitals or parks should influence where you choose to buy or rent. Prioritizing these aspects ensures that your new home aligns with your lifestyle needs and enhances your overall well-being.

Factors like community development, local market trends, and future growth prospects can further influence your decision. When evaluating locations, consider researching ongoing projects or upcoming infrastructure improvements that could enhance property values. This knowledge allows you to make a well-informed choice that not only serves your current needs but also benefits you in the long term.

Step-by-Step Guide to Buying a Home

Unlike renting, buying a home involves several important steps that require careful planning and execution. Familiarizing yourself with these steps can make the process smoother and help you make informed decisions. Below is a breakdown of the vital phases in the home-buying journey.

| Step | Description |

| 1. Get Pre-Approved | Secure a mortgage pre-approval to understand your budget. |

| 2. House Hunting | Search for homes that meet your criteria in your desired area. |

| 3. Make an Offer | Submit an offer to the seller, often negotiated through a realtor. |

| 4. Home Inspection | Conduct an inspection to identify any potential issues in the property. |

| 5. Closing | Finalize the sale by signing contracts and ensuring financing is in place. |

Pre-approval Process

There’s no better first step in buying a home than getting pre-approved for a mortgage. This process helps you determine how much you can afford, streamlining your home search. By providing your financial information, a lender will assess your creditworthiness and issue a pre-approval letter, which demonstrates to sellers that you are a serious buyer.

Home Inspection and Closing

Preapproval is an vital step to move forward, but ensuring that the home you choose is sound is equally important. After your offer is accepted, a home inspection checks for any structural or functional issues. This information not only informs your decision but can also lead to negotiations on repairs or price adjustments. Once satisfied, you’ll finalize the deal during closing, where you’ll sign necessary documents and transfer funds, officially making the house your new home.

Guide yourself through the home inspection and closing process by being proactive and informed. A thorough inspection will highlight any major repairs that need immediate attention, and understanding the closing documents ensures transparency in the transaction. Don’t hesitate to ask questions, and ensure you have a clear grasp of the financial aspects before finalizing your purchase. This attention to detail will help you avoid unexpected surprises as you transition into ownership of your new home.

Step-by-Step Guide to Renting a Home

Despite the challenges you may face in the rental market, following a structured approach can help simplify the process. Start by determining your budget and then narrow down your search area to find homes that meet your criteria. Once you’ve identified potential rentals, plan visits, ask questions, and carefully assess the properties. Ultimately, be prepared to submit your rental application promptly to secure your desired home.

| Steps to Renting | Description |

| Budgeting | Establish a clear rental budget considering all related expenses. |

| Research | Identify neighborhoods and amenities that suit your lifestyle. |

| Property Visits | Schedule tours of potential rentals; take notes on each. |

| Application Process | Prepare necessary documents and submit applications promptly. |

Lease Agreements and Terms

On selecting a rental, you’ll review the lease agreement detailing terms such as duration, rent amount, and obligations. Pay close attention to clauses that address maintenance responsibilities, pet policies, and termination conditions. Ensure you fully understand these terms to avoid surprises in the future.

Navigating Rental Applications

Home is where you will want peace of mind, so getting the rental application process right is important. Be ready to provide identification, proof of income, rental history, and references, as landlords often conduct background checks. Completing the application accurately and promptly gives you the best chance of securing the rental you desire.

Renting can feel overwhelming at times, but you can ease the process by preparing the necessary documentation in advance. Having your financial information, employment verification, and rental references organized will enhance your application. Landlords appreciate thorough and professional submissions, so aim to present yourself as a reliable tenant by demonstrating responsiveness during the application process.

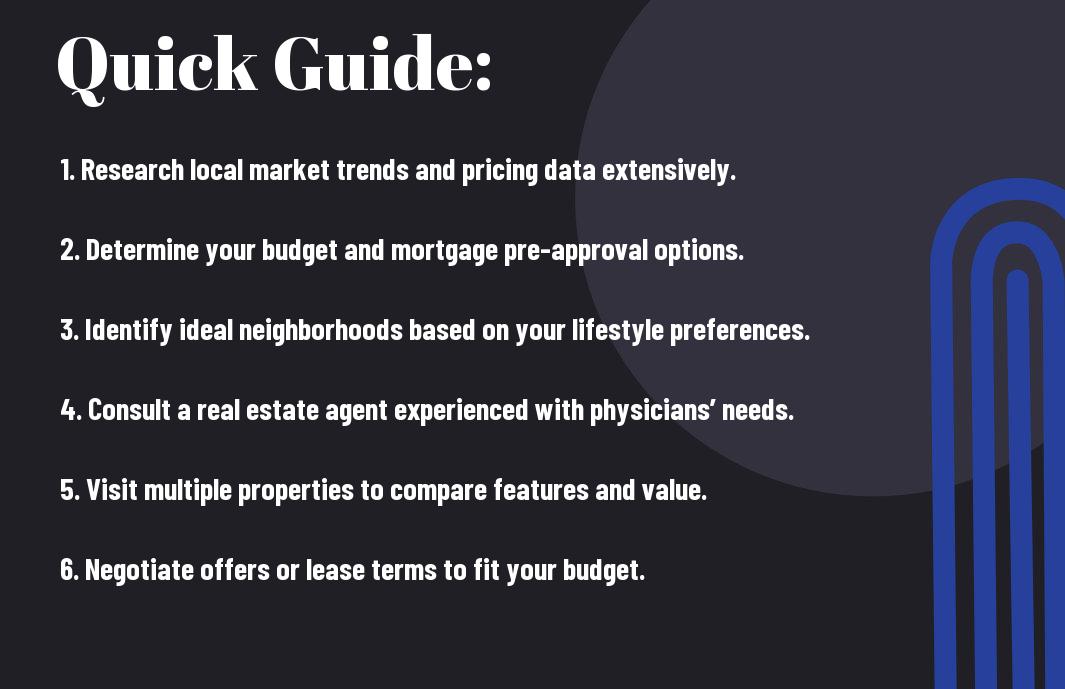

Tips for Physicians in the Real Estate Market

After navigating the complexities of the medical field, entering the real estate market can feel overwhelming. Here are some tips to help you make informed decisions:

- Understand your unique needs and lifestyle.

- Hire a real estate agent with experience in working with physicians.

- Know the local market trends.

- Be prepared to act quickly in a competitive market.

Any time spent preparing is an investment in securing your ideal home.

Time Management for House Hunting

Now that you’re ready to search for your new home, it’s vital to manage your time effectively. Block out specific days and times to visit listings, and utilize your days off or extended weekends efficiently. Keeping a flexible schedule will help you maximize your opportunities while balancing your demanding profession. Prioritize your visits based on your needs, and ensure to keep a running list of pros and cons for each property.

Financial Considerations

While purchasing or renting a home, it’s important to evaluate your financial health carefully. Assess your budget, including income, debt-to-income ratio, and savings, to determine what you can comfortably afford regarding monthly mortgage or rent payments. Speak with a financial advisor or mortgage lender to explore your options and understand the long-term financial implications of your decision.

Financial planning is key to successful home buying or renting. Consider additional costs such as property taxes, homeowner’s insurance, and maintenance when setting your budget. Obtain pre-approval for a mortgage to strengthen your purchasing power and set realistic expectations regarding your price range. By preparing your finances, you ensure a smoother property search without unwarranted stress.

Pros and Cons of Buying vs. Renting

Once again, weighing the advantages and disadvantages of buying versus renting your home can significantly impact your decision-making process. Here’s a breakdown of the pros and cons to consider:

Pros and Cons

| Buying | Renting |

|---|---|

| Equity building | Lower upfront costs |

| Stability and predictability | Flexibility to relocate |

| Tax benefits | Lower maintenance responsibility |

| Customization opportunities | Access to amenities |

| Potential appreciation | Short-term commitments |

| Protects against rent increases | No market risk exposure |

Long-term Benefits of Purchasing

Clearly, purchasing a home presents various long-term benefits, such as building equity and enjoying potential appreciation in property value. This investment not only promotes financial independence but also grants you stability as a homeowner. Over time, the wealth you generate through ownership can significantly contribute to your retirement planning and overall financial health.

Flexibility and Lower Commitment of Renting

Any decision to rent provides you with flexibility and a lower commitment level, which is particularly valuable for busy professionals like yourself. Renting allows you to easily relocate or upgrade without the burdens of property maintenance that come with ownership.

Cons of renting include limited customization options and uncertainty regarding rent increases. However, the primary appeal remains a stress-free lifestyle, enabling you to focus on your medical career while enjoying the benefits of affordable living arrangements. This flexibility allows you to embrace opportunities and transitions in your professional and personal life without being tied down to a property. You can pivot quickly should your career aspirations take you to a different city or neighborhood.

To wrap up

Ultimately, navigating the real estate market requires a thorough understanding of both your personal needs and the local landscape. As a physician, balancing a demanding career with the home-buying or renting process can feel overwhelming. However, by arming yourself with knowledge about market trends, financing options, and your lifestyle preferences, you can make informed decisions that align with your goals. Whether you’re buying or renting, taking the time to educate yourself will lead to a rewarding living situation tailored to your lifestyle.